Unlocking America’s Minerals

Ambler Road - Pros and Cons

Hi friends,

It seems nothing about politics is straightforward. Similarly, the saying about actions and equal and opposite reactions is always straightforward.

This article addresses the tricky issue of America’s need for certain minerals.

A turning point in U.S. resource policy

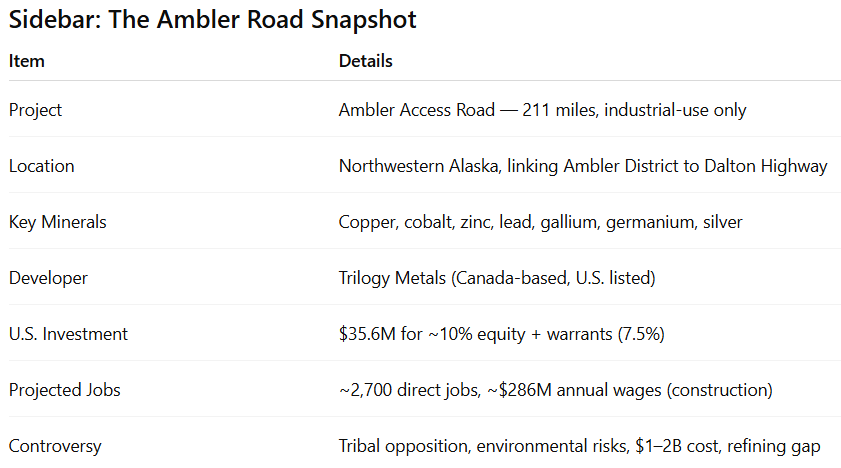

Earlier this month, President Trump’s administration reversed a Biden-era decision and approved the Ambler Road Project in Alaska. At first glance, it’s a simple infrastructure move: a 211-mile road linking a remote mining district to the broader U.S. transport grid.

But the decision goes further. Washington also announced a $35.6 million direct investment in Trilogy Metals, the company developing the Ambler Mining District, buying roughly 10% of its stock and securing warrants for another 7.5%. The federal government is no longer just regulating or subsidizing — it is now a shareholder in a private mining venture. (Note: It’s not a gimme; the U.S. is getting something for our tax dollars. Pros and cons to that too.)

Supporters call this a bold step to secure the minerals America needs for defense, technology, and energy independence. Critics see government overreach, high costs, and unresolved battles over property rights and environmental protection. Like many turning points, the reality lies somewhere in the trade-offs.

Why critical minerals matter

Critical minerals are the building blocks of modern life — and the new front line in global competition. They show up in:

High tech: semiconductors, data centers, and AI chips rely on gallium, germanium, and rare earths.

Defense: copper, cobalt, and rare earths power jet turbines, radar, and secure communications.

Energy: solar panels, wind turbines, and batteries depend on zinc, cobalt, and lithium.

The problem? The U.S. imports much of its supply and depends heavily on China, which controls 60–80% of global refining for many of these elements. Even when American companies mine raw ore, it often has to be shipped overseas for processing. That dependence represents both an economic vulnerability and a national-security risk.

The Ambler Road and Ambler Mining District

The Ambler Mining District, north of the Arctic Circle in Alaska, is one of the richest untapped deposits of strategic minerals in North America. It contains:

Copper for wiring and grid infrastructure.

Cobalt for high-density batteries.

Zinc and lead for alloys and coatings.

Gallium and germanium for semiconductors and optics.

Silver for electronics and solar panels.

Until now, the region’s remoteness has kept it off-limits for large-scale mining. The Ambler Road would change that, connecting the district to Alaska’s Dalton Highway and opening the door for industrial development.

The stakes are big: one report estimates 2,700 direct jobs and $286 million in annual wages from construction alone. Proponents argue the project could position the U.S. to compete head-to-head with China in mineral supply chains.

The upside: what’s good about it

Jobs and growth: Significant short-term construction work plus ongoing mining jobs in one of America’s most remote regions.

Resource independence: Unlocks copper, cobalt, gallium, and other elements essential for AI, clean energy, and defense.

Strategic security: Reduces dependence on foreign supply chains, particularly those controlled by adversaries.

Economic signal: Shows investors and allies that Washington is serious about building domestic capacity.

Direct alignment: By owning equity in Trilogy Metals, the U.S. has “skin in the game,” aligning federal strategy with private industry execution.

The downside: what might not be so good

Federal overreach? Washington buying shares in private industry blurs the line between government oversight and direct control. Should taxpayers be in the mining business?

Massive costs: The road alone could cost $1–2 billion. If mine production falls short, taxpayers are left holding the bag.

Local opposition: Over 80 tribal governments have passed resolutions against the project, citing threats to caribou migration, waterways, and subsistence living.

Environmental risks: The road cuts across rivers and fragile Arctic terrain. Impacts cannot be fully known.

Processing bottleneck: Even if the ore is mined in Alaska, the U.S. currently lacks enough domestic refining capacity. Domestic refining must happen.

The trade-offs: cost of doing it vs. cost of not doing it

The Ambler decision captures the central dilemma of critical mineral strategy:

The cost of doing it: Government entanglement in private industry, potential land and property rights conflicts, large public expenditures, and possible environmental trade-offs.

The cost of not doing it: Continued dependence on China, weakened defense supply chains, vulnerability in AI and energy infrastructure, and lost opportunity for domestic jobs and sovereignty.

Neither path is perfect. But the compromise position may be clear:

Ensure domestic processing capacity, not just mining.

Guarantee local consultation and fair benefit-sharing, especially with Indigenous communities.

Make sure taxpayers receive a return on investment if federal dollars are at stake.

Balance strategic urgency with constitutional limits on government power.

The bigger picture: sovereignty and supply chains

In the end, this isn’t just about one road or one mining company. It’s about whether America can chart a path toward resource independence without sacrificing the principles of limited government and property rights.

For most Americans, it’s a reminder that supply chains and sovereignty are tightly intertwined — and that strategic minerals may be the new oil. For supporters, Ambler is a bold pivot away from weakness. For opponents, it’s another example of government partnering with corporations.

Key takeaways

Critical minerals are essential to America’s future — from AI chips to fighter jets.

The Ambler Road could unlock vast supplies, but not without costs and controversy.

The U.S. government is now a direct investor in a private mining firm — a major shift in industrial policy.

The real test will be whether the U.S. also builds the refining and processing capacity to keep minerals — and their value — at home.

Further Reading:

White House Fact Sheet: https://www.whitehouse.gov/fact-sheets/2025/10/fact-sheet-president-donald-j-trump-approves-ambler-road-project-to-unlock-alaskas-mineral-potential/

Reuters on Trilogy Investment: https://www.reuters.com/business/trilogy-metals-shares-soar-us-takes-strategic-stake-2025-10-07/

ADN (opposition perspective): https://www.adn.com/opinions/2025/10/18/opinion-trump-administrations-support-for-ambler-mining-road-is-misguided/

Institute for Energy Research: https://www.instituteforenergyresearch.org/regulation/trump-signs-order-to-approve-mining-road-in-alaska/

Barron’s Insider Analysis: https://www.barrons.com/articles/trilogy-metals-insiders-stock-government-bc19a809

United we stand. Divided we fall. We must not let America fall.

VoteTexas.gov, https://www.votetexas.gov/get-involved/index.html

Disclaimer:

As always, do your own research and make up your own mind. This Substack is provided for informational and commentary purposes only. All claims or statements are based on publicly available sources and are presented as analysis and opinion, not legal conclusions.

No assertion is made of unlawful conduct by any individual, company, or government entity unless such claims are supported by formal public records or verified legal documents. The views expressed here reflect my personal perspective on property rights and land use issues.

While I strive for accuracy and transparency, readers are encouraged to verify all details using the official sources and references provided. Any references to third-party material are included solely for your consideration and do not necessarily reflect my views or imply endorsement.

If you share this content, please include this disclaimer to preserve context and clarity for all readers.

Until next time…

Please share your thoughts in the comments. Or email me, and let’s have a problem-solving conversation. I welcome ‘letters to the editor’ type emails and may publish yours. I hope we can create a caucus with positive, back-to-the-founders’-dream-for-America results. Have a topic you want to know more about?

Some housekeeping…

Going forward, you may need to check your spam folder. And please mark this address as ‘not spam.’ If the newsletter isn’t in your spam folder either, you should look in the Promotions tab.

You can always see everything on the website, RationalAmerican.org.

Thanks again for reading! I’m glad you’re here!