Understanding the Medicare Cuts

Saving Citizens' Tax Dollars

Hi friends,

Like most government programs, Medicare has not been run in a business-like manner.

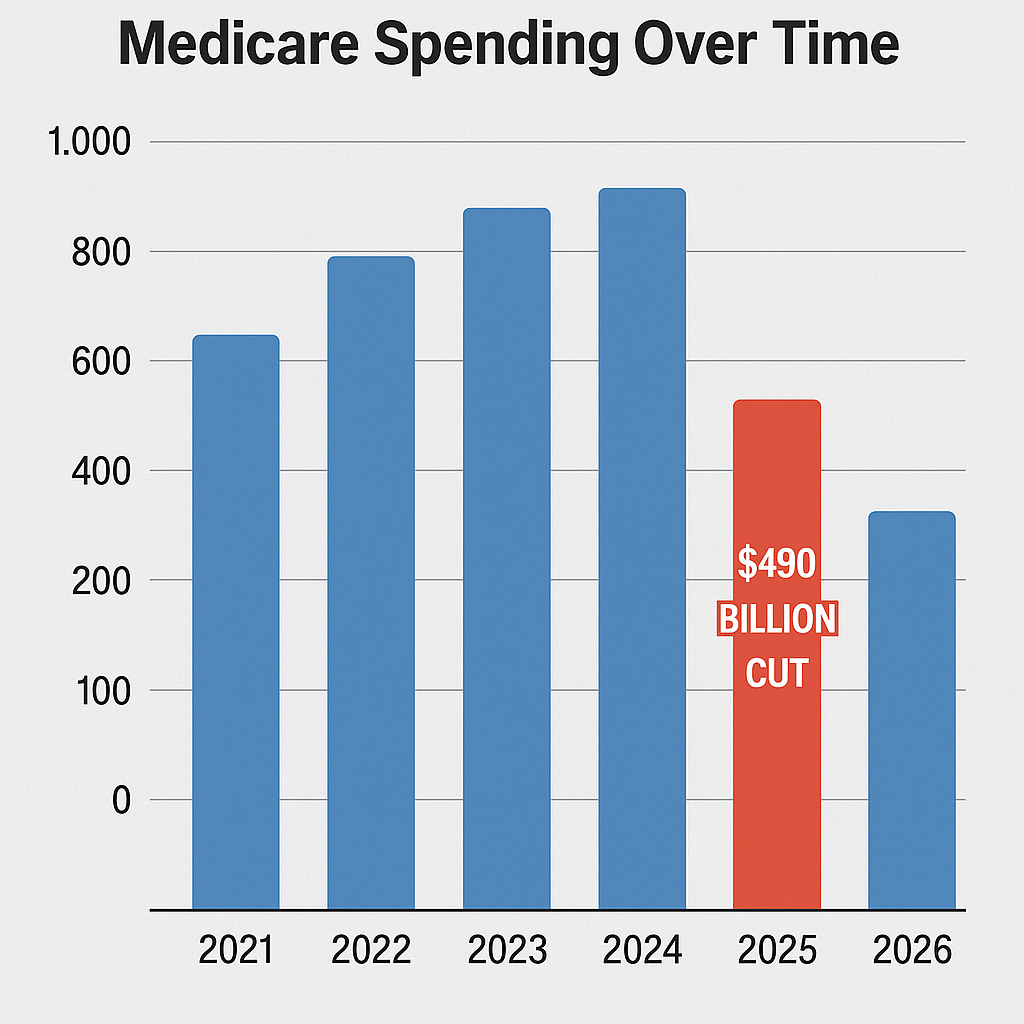

The bill the House passed calls for a $490 billion get cut. Where will the $490 billion get cut? Who is ‘harmed’ by it? Were they incorrectly paid in the first place? How do the insurance companies get paid by the government? Who abuses the system? If you’re wondering some of those things, this information may help.

You may still have questions, and the sources are included so you can continue your search for answers. All the Medicare laws and regulations must be thousands of pages, so I just touched the surface. And it may all be moot once the Senate does their part.

If $490 Billion Is Cut, Where’s My Medicare Money Going?

Medicare deductions from your paycheck don’t stop—it’s still the law.

The $490 billion cut refers to future spending reductions in Medicare’s projected budget over 10 years.

Think of it as slowing the growth, not removing what you already paid.

The money still goes into the Medicare Trust Fund. What the House passed would cut future planned spending, not payroll deductions. They’re trying to ‘save’ Medicare/taxpayer money by correcting who’s eligible and tightening reimbursements—not by canceling the taxes we pay.

Planned spending is if they spent what is currently planned, without any of the proposed changes. It’s the changes from future spending that save the $490 billion. Perhaps similar to if you pay off a car and don’t plan to spend money on another car, then you save the car payment.

🏥 Understanding Medicare Eligibility

Medicare is a federal health insurance program primarily for:

Individuals aged 65 and older

Younger individuals with certain disabilities/Special Needs Plans

People with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS)

To qualify for premium-free Medicare Part A, individuals must have:

Worked and paid Medicare taxes for at least 10 years (40 quarters)

Or be the spouse of someone who has met this requirement

Legal immigrants can purchase Medicare Part A if they:

Have been lawfully residing in the U.S. for at least five continuous years

Are 65 or older

However, illegal immigrants are not eligible for Medicare benefits, regardless of their tax contributions.

Lawful permanent residents (green card holders) can qualify under these conditions. However, other lawfully present immigrants, such as refugees, asylees, and individuals with Temporary Protected Status (TPS), can also be eligible if they meet specific criteria.

💰 Impact on Taxpaying Immigrants

Many of these lawfully present immigrants have:

Worked and paid taxes in the U.S. for years

Contributed to Medicare through payroll deductions

Despite their contributions, under the proposed bill, they would be ineligible for Medicare benefits solely based on their immigration status. This raises concerns about fairness and the potential loss of healthcare coverage for individuals who have been part of the U.S. workforce and society.

Bear in mind, this is not a done deal. The Senate is expected to make changes which must then be voted on and passed, then go back to the House to address the changes. Etc.

💰 Do Undocumented Immigrants Pay Medicare Taxes?

Yes, many do. Here's how:

Undocumented workers often pay taxes using an Individual Taxpayer Identification Number (ITIN).

Some use false or borrowed Social Security Numbers, leading to payroll tax deductions, including for Medicare.

In 2022, illegal immigrants contributed approximately $59.4 billion in federal taxes, which includes payments toward both Social Security and Medicare.

Because they are in the country illegally and working illegally they are ineligible to receive Medicare benefits despite these contributions.

💰 Yes, Insurance Companies Delay for Their Own Benefit

Medicare Advantage Payments to Private Insurers

Medicare Advantage plans are different from regular Medicare. Medicare Advantage plans are reimbursed by the Centers for Medicare & Medicaid Services (CMS) through a capitation model, where a fixed amount is paid per enrollee, adjusted for risk factors.

CMS's 2025 Rate Announcement indicates that payments to MA plans are expected to increase by an average of 3.70%, totaling over $16 billion more than in 2024.

The Medicare Payment Advisory Commission (MedPAC) provides detailed information on the MA payment system, including how capitation rates are determined.

Average Capitation Payments per Enrollee

While exact figures can vary based on geographic location and enrollee health status, CMS data and industry analyses suggest that the average annual capitation payment per MA enrollee ranges between $13,000 and $17,000.

CMS's 2025 Rate Announcement provides insights into payment adjustments and trends.

The Commonwealth Fund offers a policy primer on Medicare Advantage, discussing payment structures and averages.

Federal Government's Crackdown on Medicare Advantage Overpayments

The federal government has initiated measures to address concerns about overpayments and billing practices within Medicare Advantage plans: New York Post

CMS announced an expansion of its auditing efforts, aiming to audit all 550 eligible MA plans annually, a significant increase from the previous 60. This move is part of an "aggressive strategy" to combat fraud, waste, and abuse. Barron's

The Department of Justice has filed lawsuits against major MA insurers, including allegations of overbilling and kickbacks. WSJ

📜 "One Big Beautiful Bill" (may or may not become law)

On May 22, 2025, the House passed the "One Big Beautiful Bill," which includes significant changes to Medicaid and Medicare.

Medicaid Restrictions:

Imposes work requirements for able-bodied adults under 65.

Penalizes states that provide Medicaid to illegal immigrants by reducing federal funding.

Medicare Adjustments:

Terminates Medicare coverage for certain individuals with lawful immigration status who have worked and paid taxes in the U.S. for decades. Medicare Rights Center

Restrict Medicare eligibility to only certain categories of lawfully present immigrants, specifically:

Lawful permanent residents (green card holders)

Compact of Free Association (COFA) migrants residing in the U.S.

Certain immigrants from Cuba

Eliminate Medicare eligibility for other lawfully present immigrants, including:

Refugees

Asylees

Individuals with Temporary Protected Status (TPS)

Some of these groups, like refugees and asylees, are granted eligibility for Medicare and Medicaid directly through federal law and include certain requirements. Other groups, such as TPS holders, may be granted eligibility through regulations issued by federal agencies, which interpret and implement existing laws.

Current beneficiaries who fall into the latter categories would lose coverage after one year from the date of enactment of the legislation. The Social Security Administration would be responsible for identifying and notifying affected individuals. KFF

🔍 Clarifying Misconceptions

"Able-bodied individuals were never intended to collect Medicare."

Medicare is designed for seniors and individuals with specific disabilities, regardless of their physical capabilities.

"All citizens pay into Medicare, but not all collect."

True. Some individuals may pass away before reaching eligibility age or may not meet the work requirements.

"Undocumented immigrants are draining Medicare."

False. They contribute through taxes but are ineligible for benefits. Business Insider

📚 Additional Resources

Reuters Fact Check: Undocumented immigrants can and do pay taxes

Congress.gov: H.R.584 - No Medicaid for Illegal Immigrants Act of 2025

https://www.medicare.gov/eligibilitypremiumcalc#/eligibility

https://racmonitor.medlearn.com/medicare-advantage-capitation-rates-2025/

https://www.medpac.gov/wp-content/uploads/2024/10/MedPAC_Payment_Basics_24_MA_FINAL_SEC.pdf

https://www.commonwealthfund.org/publications/explainer/2024/jan/medicare-advantage-policy-primer

https://www.barrons.com/articles/humana-unitedhealth-stock-falls-medicare-crackdown-49a6c3c6

As always, do your own research; make up your own mind.

References to other sources do not necessarily reflect my opinions, and I make no claim to their veracity or completeness. I provide them for your consideration.

(AI may have been used in this article.)

God bless you, God bless President Trump and team, and God bless America!

Stay calm - President Trump is a businessman who operates strategically, and not everything will make sense at first. His plan to shrink government and Make America Great Again is a process, not an overnight fix. Trust the long game, not just the headlines.

This message reflects my personal perspective on current events. While I strive for accuracy, please verify details through official sources linked above. If sharing, I encourage readers to include this disclaimer to ensure clarity.

United we stand. Divided we fall. We must not let America fall.

VoteTexas.gov, https://www.votetexas.gov/get-involved/index.html

Until next time…

Please share your thoughts in the comments. Or email me, and let’s have a problem-solving conversation. I hope we can create a caucus with positive, back-to-the-founders’-dream-for-America results. Have a topic you want to know more about?

Some housekeeping…

Going forward, you may need to check your spam folder. And please mark this address as ‘not spam.’ If the newsletter isn’t in your spam folder either, you should look in the Promotions tab.

You can always see everything on the website, RationalAmerican.org.

Thanks again for reading! I’m glad you’re here!