The Cost of Convenience

Central Bank Digital Currency (CBDC)

Digital currency is in the news. I’m not personally a fan. Some say we already have digital currency and, yes, credit cards and such can certainly be called that. We all like convenience. Let’s face it, we are spoiled to all sorts of things being ‘easy’.

I’m all about freedom to choose. Freedom is the key word. When choices are taken away, that’s not good. For now, we can choose how we pay, pretty much everywhere we go.

My concern is that the choice to use cash (non-trackable funds) is being pushed out. Joe Biden signed Executive Order 14067 on March 9, 2022. There is an accompanying Fact Sheet: President Biden to Sign Executive Order on Ensuring Responsible Development of Digital Assets which seems to be a summary though I’m certainly no expert.

This step says cash is not being replaced; however, it is a ‘step’.

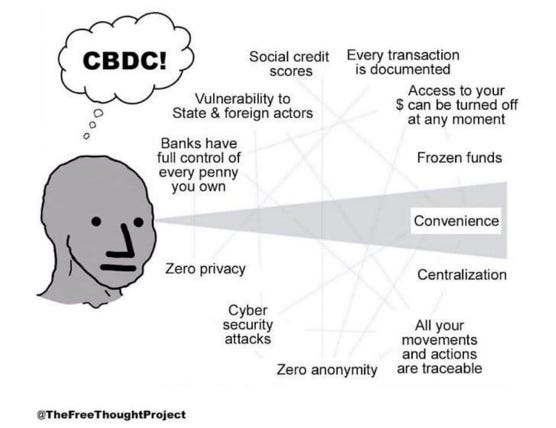

Below are some risks to keep in mind, both for Central Banking and for Digital Currency. I’ve also shared a couple of graphics you may find helpful.

Central Banking Risks:

1. Inflationary Risks: Central banks have the authority to create and regulate money supply. If not managed with the most stringent fiduciary duty, this power can lead to problems, including inflation, eroding the value of our currency and harming purchasing power.

2. Interest Rate Policy Risks: Central banks often set interest rates to control economic conditions. Mismanagement of interest rates can lead to unintended consequences, such as asset bubbles or economic instability. We’ve seen this with the Fed.

3. Financial Market Distortion: Central banks may intervene in financial markets by buying assets like government bonds or corporate securities. While these interventions can stabilize markets, they may also distort them and create long-term adverse effects. Bias is obviously a concern. Many powerful people think they know what is best for everyone…

4. Moral Hazard: During financial crises, central banks may provide bailouts to troubled banks or financial institutions (as has been done in recent history). This can create moral hazard, as institutions may take excessive risks believing they will be rescued in times of trouble. Again, we’ve seen this happen more than once. Power corrupts and especially when the powerful are using taxpayer dollars.

5. Loss of Independence: Central banks are hypothetically designed to operate independently from political influence. However, when government is the central bank and the central bank is the government, that is not just a risk, but the closest thing to a certainty.

6. Market Speculation: Central bank actions and statements can, and do, influence market speculation and investor behavior. Central bank signals can lead to unexpected market volatility endangering financial stability.

Digital Currency Risks:

1. Privacy Concerns: Digital currencies can be designed with varying degrees of privacy. If not designed to stringently protect privacy, they expose users to privacy violations, surveillance, and potential data breaches.

2. Security Risks: Digital currencies are vulnerable to hacking and cyberattacks. If not adequately protected, digital wallets and transactions can be compromised, leading to financial losses.

3. Digital Divide: Not everyone has equal access to digital technology or the internet. Implementing a digital currency system may exclude those without access, exacerbating inequality.

4. Centralization of Data: Digital currency systems often centralize personal and financial data, creating a single point of failure. If this central database is compromised, it will have severe consequences. Identity theft doesn’t begin to describe it.

5. Lack of Regulation: Some digital currencies operate in a regulatory gray area. The lack of clear regulations often lead to fraud, scams, and a lack of investor protection, not to mention human error in judgement.

6. Volatility: Some digital currencies will have price volatility. This can make them unsuitable for everyday transactions and raise concerns about speculative behavior.

7. Loss of Anonymity: While some digital currencies promise anonymity, they can still be traceable, leading to concerns about government surveillance or unwanted tracking. We’ve all seen hacking at the highest security levels of major corporations and the federal government including military. We’ve also experienced the government forcing businesses to hand over personal information that was supposed to be protected by Constitutional rights.

8. Legal and Regulatory Risks: The legal and regulatory environment for digital currencies varies by country and is subject to change. This uncertainty creates risks for users and businesses. (I can’t imagine that all the countries would be on the same ‘regulatory’ page all of the time.)

Both central banking and digital currencies have their advantages as well. Properly managed, they can contribute to economic stability, financial innovation, and greater convenience. However, understanding and mitigating the associated risks is crucial for their successful implementation and use. (I recommend you do your own research on how CBDCs are working in the countries that already have them and on how the citizens are faring.)

My opinion is that convenience is the advantage to We the People, but the bigger advantage, by far, is the traceable, surveillance, intrusion on privacy, tracking, and control by bad actors, specifically government, and the path to ESG and social credit scores as China already has.

The European Union has introduced - in 2021 - a new ‘digital’ ID. Then there’s this from Thales Group which tells us this among other things: “In a nutshell, by 2024, every EU member state must make a Digital Identity Wallet available to every citizen who wants one.” You’ll notice the articles are positive and don’t mention the other side.

(You can also check out my Substack on FedNow. The U.S. FedNow system went live on July 21, 2023. It’s open to all (?) financial institutions, so does that mean your financial institution could control whether or not you will have a choice? You may have been hearing about ‘debanking’. I’m working on a newsletter with more on ‘debanking’.)

This Texas A&M article, What The Biden Administration’s Executive Order Means For The Crypto Industry, has some good information too. It is notable that it includes ‘advantages of having a regulatory framework in place‘ but does not comparably include the disadvantages.

And here’s a commentary from Brookings.edu, How Biden’s executive order on cryptocurrency may impact the fate of digital currency and assets.

"The last hope of human liberty in this world rests on us. "

— Thomas Jefferson

Until next time…

Please share your thoughts in the comments. Or email me, and let’s have a problem-solving conversation. I welcome ‘letters to the editor’ type emails and may publish yours. I hope we can create a caucus with positive, back-to-the-founders’-dream-for-America results.

Some housekeeping…

Going forward, you may need to check your spam folder. And please mark this address as ‘not spam.’ If the newsletter isn’t in your spam folder either, you should look in the Promotions tab.

You can always see everything on the website, https://ellenleyrer.substack.com.

Thanks again for reading! I’m glad you’re here!

Have a topic you want to know more about?