Growing the IRS

Power, Taxes, and Guns

Another abuse by government bureaucracy? Not only does the Inflation Reduction Act not reduce inflation, not only does it raise taxes, it almost doubles the size of the IRS, and it literally provides weapons to more IRS agents. $80 million of Americans' tax money but, hey, the IRS will get that back and more; it’s an investment. (Sarcasm intended.) You have seen the news items saying that the Biden administration is weaponizing the IRS. Typically that means using the government organization to intimidate or cause harm to their opponents/political enemies. In this case, it also means the IRS will use actual guns against citizens. Rightly or wrongly? Who knows? Personally, I’m not feeling too confident in our current government’s consideration of our God-given and Constitutional rights.

Government is just too big. The nature of the beast is to grow and continue to give itself more and more power. It’s supposed to be ‘of the people, for the people, by the people’… Well, that’s way too much to get into here. Many books have been written. I recommend Mark Levin’s The Liberty Amendments.

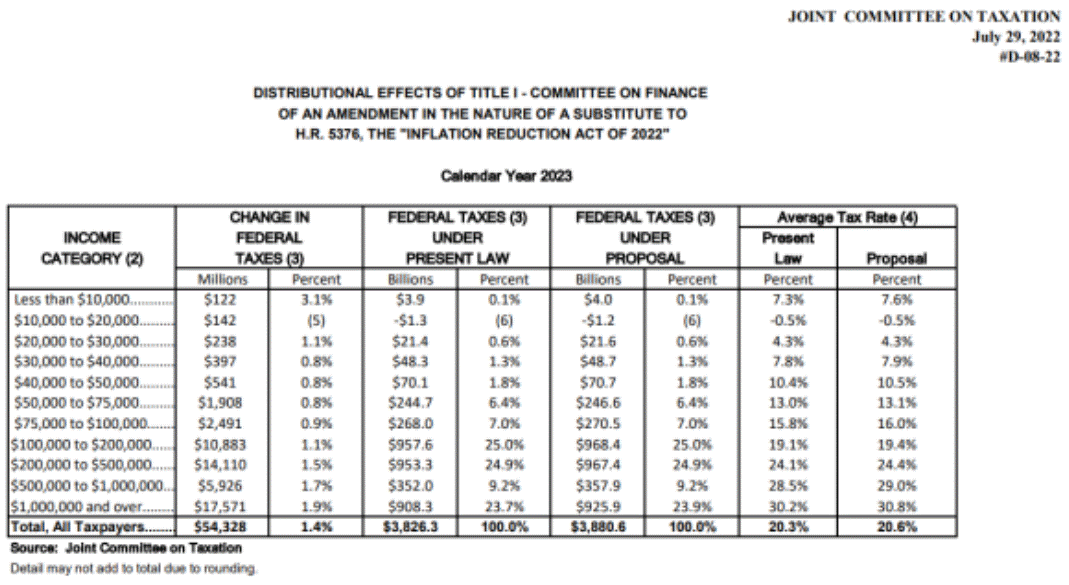

The nonpartisan Joint Committee on Taxation (JCT) estimates the Democrats’ latest reckless tax-and-spend proposal will increase taxes on millions of Americans across every income bracket, with more than half of the tax increases on Americans making less than $400,000 per year. It is estimated that the bill will raise $16.7 billion in taxes for Americans making less than $200,000.

Fact Check: Is the IRS Buying Ammunition and Guns? From Market Realist.

Americans have every right to question the Democrats' intention to hire 87,000 new IRS agents. While Democrats may claim the resulting additional audits are meant to target high-income tax evaders, analysis shows that middle-class Americans would receive most of the audits.

They can’t claim good intentions. When Democrats had a chance to back up their claims, all 50 Democrat senators voted against Senator Mike Crapo’s amendment that would have ensured that individuals and small businesses making less than $400,000 would not be targeted by the additional audits.

The IRS website's job description for special agents included the requirement that they be able to carry a firearm and be willing to use deadly force if necessary. However, as of Friday morning, the listing had been edited to omit those two requirements.

‘Yes, the Internal Revenue Service did buy nearly $700K in ammunition in early 2022’. (verifythis.com is rated ‘center’ for bias.)

On July 1 Congressman Matt Gaetz (R-FL) introduced the “Disarm the IRS Act,” which would prohibit the Internal Revenue Service (IRS) from acquiring ammunition. Quote from Matt Gaetz:

There is concern that this is part of a broader effort to have any entity in the federal government buy up ammo to reduce the amount of ammunition that is in supply, while at the same time, making it harder to produce ammo. If that happens, you cannot fully exercise... your Second Amendment rights if you are unable to acquire ammunition in your own country because your government has reduced the production of that ammunition, and then on the other hand, tried to soak up the supply.

Gaetz had previously claimed the IRS purchases hundreds of thousands of dollars worth of ammunition. In an interview published in June by Breitbart reported that Gaetz said the IRS bought approximately $700,000 in ammunition “between March and June 1” - a 3 month period. (Another 3-minute interview with Matt Gaetz here.)

More in-depth info:

From the Daily Signal - 4 Facts About IRS Gun Arsenal.

From Americans for Tax Reform - IRS Has 4,600 Guns and Five Million Rounds of Ammo: Will Dem Bill Grow Arsenal?

Guns and ammo for the IRS is not a new thing:

2021 - How Many Guns Does the IRS Have?

2019 - Forbes asks: IRS Has 4,500 Guns, 5 Million Rounds Ammunition: Paying Taxes?

2016 - Wall Street Journal: asks Why Does the IRS Need Guns? The article by Dr. Coburn is a physician and former U.S. senator from Oklahoma. He is the honorary chairman, and Mr. Andrzejewski is the founder and CEO, of OpenTheBooks.com, a repository of public-spending records.

2014 - The Gun-Toting IRS

In 2013, it was a massive scandal when Lois Lerner admitted the IRS had targeted tea party-related groups.

What can be done? Being informed is the first step. You rock! Next, reach out to your Congresspersons and express your concern. And always speak up. Being the silent majority is not working. After the midterms, more concrete actions will be available.

Until next time…

You can always see everything on the website, https://ellenleyrer.substack.com.

Please share your thoughts in the comments. Or email me, and let’s have a problem-solving conversation. I welcome ‘letters to the editor’ type emails and may publish yours. I hope we can create a caucus with positive, back-to-the-founders’-dream-for-America results. Have a topic you want to know more about?

Some housekeeping…

Going forward, you may need to check your spam folder. And please mark this address as ‘not spam.’ If the newsletter isn’t in your spam folder either, you should look in the Promotions tab.

Thanks again for reading! I’m glad you’re here!